Independent think tank the Australian Strategic Policy Institute (ASPI) has delivered a report examining the bids for the $35 billion SEA 5000 project ahead of the government's decision, which is expected to be announced this week.

The report, by Andrew Davies, Michael Shoebridge and James Mugg, examines the strengths and weaknesses of each vessel in the competition, and identifies the four major factors that will decided the winning vessel and ultimately the future of Australia's naval warship building industry.

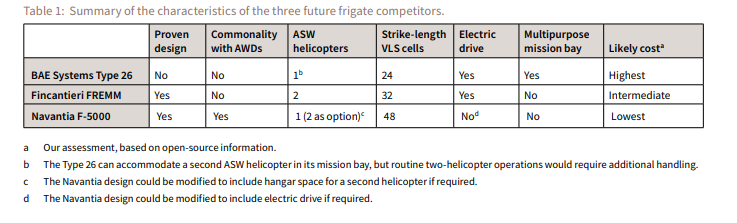

The report argues the Navantia vessel is "almost certainly" the least risky of the three contenders from a project risk perspective, given Navantia would be able to start work relatively quickly as the Air Warfare Destroyer project winds down, a vessel designed by the Spanish company. The report also suggests the design would offer commonality with the Royal Australian Navy's existing fleet, but says its downside is that the design has not been produced with ASW as its main mission.

"Its baseline design has more missile cells than either of the other contenders, and the Hobart Class AWD starting point brings with it the Aegis combat system and US Navy weapons from the start, unlike the other designs," the report said.

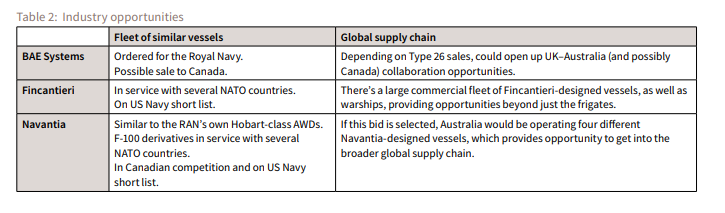

"The Hobart Class pedigree means it’s a multipurpose combatant with ASW capabilities, rather than a design optimised from the start for ASW as its primary mission. Navantia Australia already has some 150 employees working in the shipbuilding and design domain, so winning the SEA 5000 contract would build on that foundation. There would be greater commonality with the RAN’s existing fleet than with the other options, and the potential for Australian industry to feed into Navantia’s global supply chain."

The bid from Italian company Fincantieri will be looked upon favourably for its hangar capacity, ASW design and its Australian industry plan, and there is the added benefit that it is already a proven vessel since it is already in service with European navies. But there is a project risk in working with a new designer that has yet to play a role in the Australian shipbuilding industry, the report found.

"In terms of project risk, there’s the potential difficulty of working with a new designer that’s unfamiliar with the Australian shipbuilding environment. And the benefits of a vessel already in service are partially offset by the fact that practically none of the Italian FREMM’s major sensor and weapon systems – VLS, radar, CMS and possibly sonar – would be preferred for an Australian design," the report said.

"The net result is that the main attractions of the Fincantieri design are its hangar capacity, its relatively new design and its ASW-specific systems. On balance, it’s well suited to the ASW-specialist role promulgated in the Defence White Paper. There’s considerable scope on the industrial side from Fincantieri’s substantial global fleet of both military and commercial vessels, opening up the possibility of Australian firms contributing to a broad global supply chain."

The bid from the UK's BAE Systems is considered to be the most modern design, with multiple ASW features on offer. The bid also offers an opportunity for Australian industry to enter a broad global supply chain, given variants of the vessel are on offer to Canada and Australia, and are currently being produced in the UK. Australian businesses are already supplying components for Batch 1 of the UK Type 26 program, and more are expected to support construction and equipment manufacture for Batch 2.

However, the obvious disadvantage is that the vessel is yet to hit the water and the Type 26 has no commonality with the AWD design, the most recent vessel to be built in Australia, meaning that there would be a substantial learning curve for production engineering and construction compared with the Navantia design, the report argued.

"The skills needed to build many of the advanced features incorporated in its design will take time to acquire in the Adelaide yards," the report said.

"There’s a lot to like about the capability promised by the Type 26, and it’s the most modern design in the competition. It has several attractive ASW features as well as a multipurpose mission bay that will enable rapid configuration for other tasks. The downside is that its capabilities aren’t yet proven. The supply chain opportunities with the BAE Systems bid relate closely to its success in further Type 26 sales as well as to additional successful negotiations to gain access for Australian suppliers into the UK’s Type 26 program."

Each bid has pros and cons and different risks, but ASPI has determined the four discriminators it believes will define the decision:

• ASW performance: It remains to be seen exactly how important ASW specialisation is, but both the Fincantieri and the BAE Systems designs seem to have an edge over Navantia’s. BAE has the advantage of the most modern design with advanced quietening techniques designed in, while Fincantieri also offers acoustic reduction measures and can provide for hangars for two ASW helicopters from its baseline design. (In the case of BAE, the judgement on capability relies on confidence in the design, not measured performance of a ship in the water).

• Project risk: Navantia has the advantages of workforce experience from the Hobart Class AWD program and having lived the lessons from that program, as well as already having integrated the Aegis combat system into the design. The shipyard advantages are lessened, however, by the fact that the future frigates will be built in a new facility and by the recent rundown of the AWD workforce.

• Industrial strategy: Fincantieri has the broadest market and supply chains because it builds both commercial and military ships for the global market, but the extent of Australian access to that global supply chain will depend on the details of the tender and the government’s ability to negotiate. Navantia’s military supply chain has commonality with the RAN’s Hobart Class, amphibious and at-sea replenishment ships. The scale of BAE’s program is still being defined. (It’s possible, of course, that either of these firms could be offering better intellectual property rights and more compelling supply chain involvement in their bids, which would change the assessment.)

• Cost: The Navantia design will probably be the most efficient to implement in Australia’s shipyards due to commonality with the AWD and is likely to be the least expensive option, unless significant design changes to achieve high-performance ASW requirements are imposed. The advanced capabilities and design of the Type 26 probably make it the most risky to start on here, and possibly the most expensive.

Regardless of which company wins the project, the nine vessels will be built in Adelaide, South Australia at the Osborne shipyard, however, whether ASC will play a large role in the build process remains to be determined.